As the coronavirus crisis rattles the global economy, many investors are fleeing for the exits. But not us, and not you. We’ve built EXM for precisely these sorts of environments.

9 out of 10 EXM clients have been buying as EXM has outperformed the market average YTD across all risk profiles.

Below are a few takeaways on how we’ve been navigating the market and generating outperformance for you.

1) EXM clients have outperformed other investment managers this year. We are pleased with how well our 20 Flagship stocks have held up, especially since many are “higher beta” companies (i.e. historically higher daily ups/downs vs. the market).

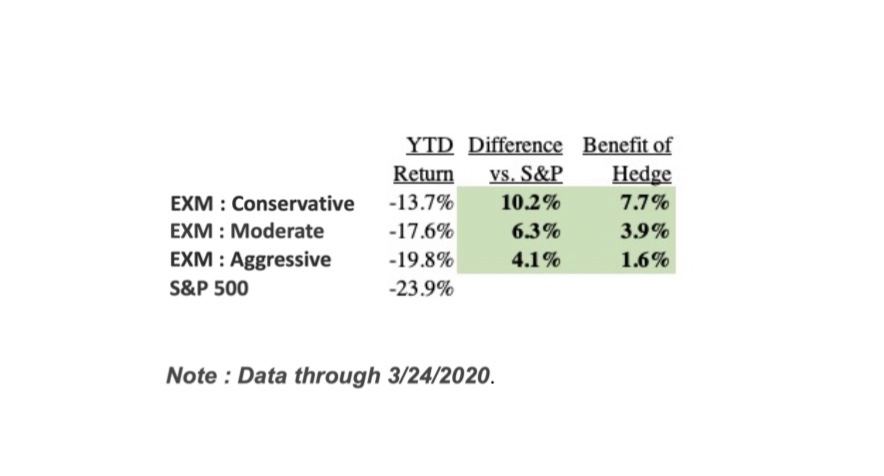

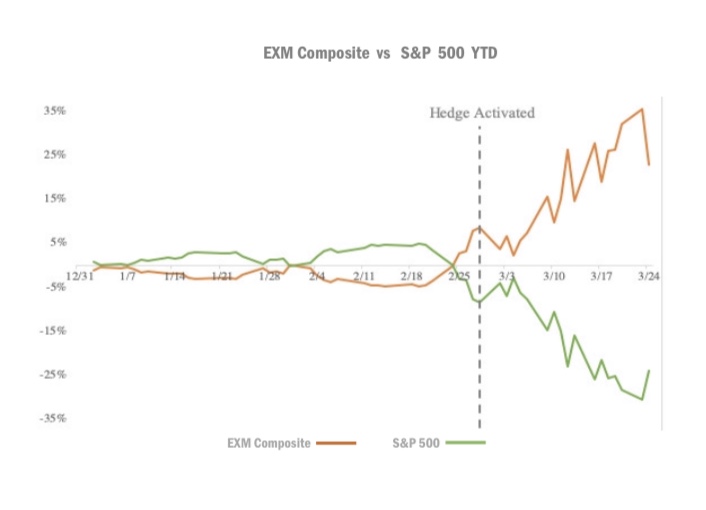

Our hedge is up +23% YTD and +13% since we activated full protection in early March, enabling our hedging strategy to add 2-8% return to your portfolio YTD (based on your risk profile), compared to if you had just owned the EXM Stock Composite

Combining the EXM stocks Composite (long) and the hedge (short), we’ve delivered 4-10% better returns for our clients this year vs. the S&P. Our hedge has delivered against its objective so far: earning you profits when the market enters a significant downturn.

We believe we’re well-positioned to manage your money through this crisis and continue generating outperformance vs. the market. Your EXM stocks Composite are durable, defensive growth businesses poised to weather a downturn, and your hedge is built to mitigate a further drawdown from here.

Let us know if you have any questions.

Best

Peter,

Chairman EXM Capital