High yields create long-term opportunities for investor

Key Insights

We have upgraded our outlook for emerging markets (EM) debt on the basis of historically high yield levels and growing macro support

- EM debt could be a profitable investment over the medium to longer term despite ongoing coronavirus-related concern.

- We believe EM debt’s history of quick rebounds following periods of spread widening means it is important for investors to be early to reenter the asset class.

- An active approach is important to identify where spread levels can potentially offer the best compensation for the ongoing risks to EM.

Emerging markets (EM) debt is looking increasingly attractive following the sharp but brief sell‑off so far this year. While we remain concerned about the coronavirus and its economic impact, the recent indiscriminate selling means valuations in EM debt are becoming too good to ignore. Even if volatility persists in the near term, we believe EM debt can be a profitable investment over the medium to longer term. Therefore, we have upgraded our outlook for the asset class because we believe investors can find ways to take advantage of the recent dislocations.

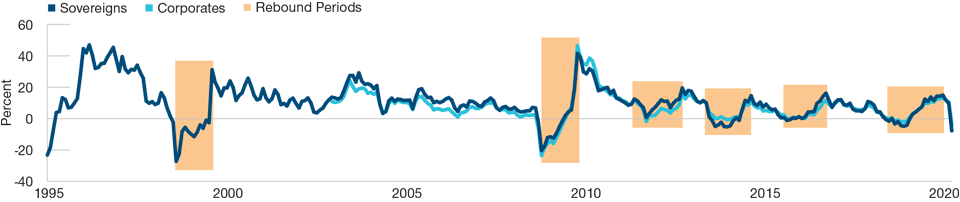

Early Bird Gets the Rebound

Too often, we hear investors debating where and when a market has reached its bottom while trying to pinpoint the optimal time to reenter an asset class. History shows that following previous downturns, EM typically recovered quickly. Consequently, investors could miss out if they wait until it is clear that the nadir is behind us. In EM, it pays to be early.

In EM, it pays to be early.

With index yields over 7%,1 the yield differential between EM and developed market (DM) bonds has reached a point where EM could be one of the more profitable investments in the current landscape. Spreads have spiked as U.S. Treasury yields plummeted amid a flight to safety. Successive monetary and fiscal stimulus measures in the U.S. and other major markets have added to the downward pressure on core yields while supporting credit assets. In our view, holding ultralow and negative‑yielding DM bonds appears like an asymmetric risk, as DM yields are unlikely to go much lower even if risk aversion continues in the near term.

Double-Digit Rebounds After Sell-Offs

EM debt rolling 12-month returns

As of March 30, 2020.

Past performance is not a reliable indicator of future performance.

Source: J.P. Morgan Chase & Co. (See Additional Disclosure.)

Y-axis = rolling 12-month returns, %.

Sovereigns are represented by J.P. Morgan Emerging Market Bond Index Global Diversified.

Corporates are represented by J.P. Morgan Corporate Emerging Market Bond Index Broad Diversified.

Therefore, we think EM hard currency bonds have strong potential even without identifying a specific floor. Yields have reached levels that should compensate investors for further near‑term price swings while delivering strong returns potential when the outbreak eases and markets recover. Being early is always a risk during times of uncertain market direction. However, it is usually necessary when the supply of cheap assets is limited. We are confident that buying EM bonds with yields in the 7% to 10% range and selling DM bonds with yields around 0% to 1% will likely form profitable investment opportunities for us over the next year.

Selective Approach Can Find Strong Fundamentals

The sky‑high EM yields are also dislocated from fundamentals in much of the asset class. We expect the economic impact from coronavirus to last for several more months. However, most expectations are for the situation to stabilize and improve sometime later this year. In this light, we think investors are well compensated by current yields for the actual credit risk in EM.

buying EM bonds with yields in the 7% to 10% range and selling DM bonds with yields around 0% to 1% will likely form profitable investment opportunities for us over the next year.

A disciplined, active approach is essential, in our opinion, when reentering or increasing exposure to EM amid the uncertain backdrop. Much of the recent selling has been driven by passive exchange‑traded funds meeting heavy redemptions. Such indiscriminate selling means that bonds from countries exhibiting relatively stable fundamentals have sold off heavily along with the rest of EM. We view these names as attractive opportunities. Names with poor or deteriorating fundamentals will likely continue to get punished amid the ongoing economic downturn.

We also believe that when markets do stabilize, it is unlikely that all prices will return to their pre‑coronavirus levels. Certain countries and sectors will likely recover at different paces and more strongly than others. Bottom‑up security selection can help identify the countries and individual bonds that may be best positioned to weather bouts of volatility and then potentially rally when the backdrop improves.

An active approach can also uncover hidden correlations within EM that can impact returns. Some investment‑grade‑rated sovereigns, such as those of Saudi Arabia and Qatar, have traded with higher sensitivity to moves in U.S. Treasuries. During the recent sell‑offs, bonds from these countries often held up better than other areas of EM as their prices were dragged higher by the rally in core DM bonds. Exposures such as these may make sense for the short term, but we see less value in many of these investment‑grade names going forward. Investment‑grade bonds with higher correlations to U.S. Treasuries, which, in our view, have little room to improve, could lag as credit appetite improves.

Conversely, we find many BB and BBB rated sovereigns could be poised for rebounds in the medium term. Russia, Brazil, and Indonesia are examples of EM credits still offering relatively healthy balance sheets and stable domestic politics that have still suffered sharp price declines as investors have shed risk.

The Worst Could Be Behind Us

Successive measures by global policymakers in recent weeks could help improve EM stability going forward. While we cannot say when and where the EM sell‑off will peak, we do see a few reasons for optimism over the medium term:

- Government fiscal stimulus and central bank monetary support—Multiple levels of support from policymakers globally will likely reduce the negative economic impact of the outbreak. We still expect further bouts of selling pressure in the coming weeks and months as the threat from coronavirus evolves. However, the concerted engagement from policymakers should help markets remain functional and liquid, which has moderated panic selling over recent sessions.

- International Monetary Fund (IMF) reform programs—The IMF has said it is prepared to lend up to USD 1 trillion globally, which should support wider sentiment. IMF programs that are already in place with specific EM countries will hopefully encourage them to stick to positive reform processes, which should help maintain overall credit quality during and after the coronavirus‑related downturn.

- Stabilization in China—The coronavirus outbreak is currently easing in China, and the country’s economy should steadily return to normal. China’s economy, in many ways, remains the engine of EM, and a rebound there would likely boost wider EM markets.

We also recognize that the coronavirus outbreak is a unique and highly uncertain event. Volatility could remain longer than expected, and the economic and human impact could be felt for some time. Investing in a risk asset such as EM in this environment comes with uncertainty. However, we think current levels can potentially offer attractive compensation for this risk. We believe staying selective and patient is essential. By prioritizing bottom‑up research, we believe investors can generate alpha over medium‑ to longer‑term horizons.

What we’re watching next

Frontier markets can also represent interesting opportunities for alpha over the medium to long term. These more volatile markets could experience further weakness in the near term as economic concerns are heightened. However, a selective approach could identify specific countries that show potential for strong rebounds if investors can remain patient through the volatility. We particularly like economies receiving IMF support while engaged in positive reform programs, most notably Ukraine.