Selectivity is critical to positioning for energy’s recovery rally

Marek Bielec , Portfolio Manager

Key Insights

- We see the potential for a powerful, countercyclical rally in oil prices and energy stocks over the next 12 to 24 months.

- We expect the secular bear market in oil to persist over the long term, driven by ongoing productivity gains.

- We are finding select investment opportunities in the cyclical, oil price‑sensitive parts of the energy sector.

An unprecedented level of demand destruction—thus far equivalent to roughly one‑third of global crude consumption—has decimated oil prices, briefly driving them into negative territory. Energy stocks have also been pummeled.

The question for equity and fixed income investors is whether this carnage creates compelling investment opportunities in energy stocks or whether it is a cyclical bust in a sector they should avoid. Marek Bielec, the portfolio manager of the Global Natural Resources Equity Strategy, sees the potential for a powerful, countercyclical rally in crude prices and energy stocks that could last between 12 and 24 months.

However, his longer‑term outlook for oil and the energy sector remains less sanguine. Ongoing productivity gains from automation and improved reservoir management techniques in U.S. shale fields, among other factors, should continue to make hydrocarbons easier and less expensive to extract, likely ensuring that crude oil remains mired in a secular bear market.

Successful investing in the energy sector requires balancing these near‑ and long‑term views for oil while focusing on the names that should provide meaningful leverage to the recovery rally—without making concessions to quality. Selectivity will be critical: Some energy companies won’t make it to the other side of this crisis, while some survivors could find themselves in too weakened a state to compete effectively.

Pain Begets Healing

Negative oil prices signal a need for the industry to take dramatic actions to align supply with demand. Marek believes that producers are likely to “over‑cut” output, which would stop storage tanks from filling and then start to drain the glut. The lifting of quarantines implemented to restrict the spread of the coronavirus would also help to draw down oil inventories by boosting demand.

“Selectivity will be critical: Some energy companies won’t make it to the other side of this crisis, while some survivors could find themselves in too weakened a state to compete effectively”.

The portfolio manager envisions a scenario where a lack of capital expenditures in the oil and gas industry accelerates the fall in hydrocarbon production (especially in U.S. shale, where wells tend to exhibit steeper decline rates), prompting crude prices to rise to levels that incentivize operators to invest in new wells. “In fact, we’re of the view that West Texas Intermediate crude oil could hit USD 45 to USD 50 a barrel by next year,” Marek says.

Less Capital, More Discipline

With the energy sector in turmoil after oil prices collapsed for the second time in five years, the capital markets are likely to be less inclined to provide a backstop this time around. Marco Kaiser, portfolio manager for the Credit Opportunities and High Yield Bond Strategies, observed that “many of the distressed and high yield investors who participated in any of those deals five years ago lost a lot of money and are unlikely to repeat that mistake.”

Marek believes that the pain suffered by investors and management teams should lead to greater discipline in how energy companies allocate capital. For the remainder of the secular bear market in crude, outspending operating cash flow should be “a thing of the past” for oil field services and exploration and production (E&P) companies—businesses with revenues that tend to exhibit greater sensitivity to energy prices. In the case of E&Ps, this shift should translate into a more balanced mix of production and free cash flow. Share buybacks, which Marek believes make less sense for a cyclical commodity producer, likely will stop, though special dividends could emerge as a more appropriate alternative.

Industry consolidation could also be in the cards, with the major integrated oil companies that are interested in expanding their presence in U.S. shale likely to pursue strategic acquisitions in the Permian Basin, an oil‑rich area in West Texas. Marco believes that shale oil plays have reached a stage in their development where the major oil companies’ technical sophistication and experience with project management are needed to unlock value and boost recovery rates from shale formations (currently, 7% to 8% of oil in place) via reservoir management technologies.

Finding Investment Opportunities in the Energy Sector

Marek describes his outlook for the energy sector as “cyclically optimistic” for the next one to two years but “structurally bearish” over the long term. He is finding some opportunities in the major integrated oil companies as well as E&Ps and oil field services firms, where undemanding valuations and the potential for a countercyclical rally in oil prices create a compelling risk/reward profile for high‑quality names.

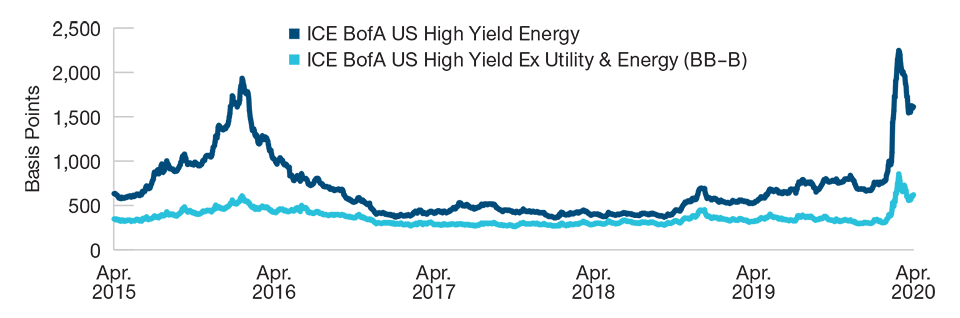

Wide-Spread Panic in High Yield Energy

Yield Spreads vs. 10-Year U.S. Treasuries

As of April 24, 2020.

Source: EXM Capital calculations using data from FactSet Research Systems Inc. All rights reserved.

Among E&Ps, Marek continues to focus on low‑cost operators that boast good balance sheets and sizable inventories of quality locations to drill wells. Although he likes many of the oil majors’ strong balance sheets, Marek has become more selective in that industry, avoiding names where strategic shifts could result in identity crises that distract management teams and dilute returns.

Marek is finding select investment opportunities among oil field services companies and believes that the likelihood of a wave of bankruptcies in the space, coupled with the flight of labor from the industry, could enable the survivors to raise prices for the first time in a long while. Moreover, with E&Ps slashing their capital expenditures in response to crashing oil prices, he sees the potential for a snapback in spending on services as crude prices and activity levels recover.

The View From a Value Investor

Ryan Hedrick, associate portfolio manager for the Large‑Cap Value Equity Strategies, favored utility stocks prior to the current pandemic‑driven downcycle. He now sees a rich slate of opportunities for utilities to potentially grow their rate bases and earnings through capital investment, driven by some of the following secular tailwinds:

- The shift from coal to natural gas and renewables for electricity generation;

- A corresponding mandate to modernize transmission and distribution infrastructure;

- The need to invest in older infrastructure to improve safety and reduce downtime; and

- The push to harden these critical systems against wildfires, hurricanes, and other natural disasters.

Although utilities’ resilient cash flows and dividend yields give the sector its defensive reputation, the outlook for earnings growth makes the group’s risk‑adjusted value proposition more attractive.

However, Hedrick is also finding opportunities in energy stocks that offer attractive dividend yields, including select midstream names that own pipelines and other energy infrastructure and should generate more durable cash flows than their peers. The major integrated oil companies also fit this profile, to an extent.

The value‑oriented Hedrick agrees with Marek that the magnitude of pain has created an emerging opportunity in the more cyclical parts of the energy sector, specifically E&P and oil field services companies. In evaluating potential investments in these industries, he’s paying close attention to balance sheets and near‑term cash flow stress to avoid companies that might need to transfer equity value to creditors by borrowing at expensive levels. Given the challenging longer‑term outlook, his analyses also assume modest valuation multiples and reasonable midcycle prices for energy commodities.

Smaller Opportunity Set in High Yield Energy Bonds

Rayburn notes that quality concerns mean that he has found a smaller opportunity set in his high yield universe. He has remained cautious, citing expected lower recovery rates on energy defaults during this downturn and a proliferation of lower‑quality issues from smaller E&P and oil field services names. At this juncture, he expects there to be meaningful bankruptcies and defaults in the high yield energy market.

Like his counterparts on the equity side, Rayburn prefers to focus on quality because of the energy sector’s challenging long‑term outlook. He favors larger E&P companies that have relatively low leverage as well as higher‑quality midstream operators that have generated relatively stable cash flows and serve diverse, well‑positioned customer bases.

The fixed income manager believes compelling opportunities in the energy sector could emerge when investment‑grade issuers get downgraded into the high yield universe. These “fallen angels” often come under pressure from forced selling by strategies that can only hold securities from investment‑grade companies. Rayburn notes that this strategy worked well during the 2015–2016 oil price collapse. Some fallen angels eventually could become “rising stars” and regain their investment‑grade ratings after repairing their balance sheets.

What we’re watching next

We continue to monitor the growing popularity of investment strategies that consider environmental, social, and governance (ESG) factors and their implications for energy stocks. We acknowledge that this trend could continue to weigh on valuation multiples in the sector as some investors discount the long‑term value of oil reserves. We factor this consideration into our bottom‑up research and decision-making. That said, we do not expect ESG factors to meaningfully affect oil market fundamentals over our investment horizon.

Portfolio Manager

Marek Bielec is a portfolio manager in the U.S. Equity Division. He is a lead manager for the Global Natural Resources Equity Strategy.