Asher Schur, Head of Asset Management, Alfons Darnst Senior Financial Advisor

Four themes driving our Midyear Market Outlook.

Key Insights

- The sustainability of rallies in equity and credit markets will depend on the trajectory of the coronavirus and the strength of the economic recovery.

- The pandemic appears to have accelerated the growth and market power of the major technology platform companies by at least several years.

- Corporate credit is likely to offer the most attractive opportunities to fixed income investors, but wide dispersion requires selectivity.

- We believe the pandemic could exacerbate political risks in some countries and prompt a major reassessment of corporate finances and supply chains.

Fiscal and monetary stimulus appeared to stave off the worst in capital markets since the coronavirus spread across the globe. But as economies gradually reopen, we believe a sustained recovery will largely depend on controlling the virus in the second half of 2020 and beyond.

“Investors should pay close attention to whether we get a second wave of infections as economies reopen,” cautions Asher Schur, head of asset management.Expectations that a vaccine can be developed and administered relatively quickly may be overly optimistic, he adds. Nor is it clear when effective drug therapies might become available. “There’s very limited visibility about that sort of relief.”

Amid uncertainty, asset returns are likely to remain uneven across countries, sectors, industries, and companies, creating potential to add value with a strategic investing approach but requiring careful analysis to identify opportunities and manage risk. “Investors will need to dig deeply to find the green shoots of recovery at the local level,” .

In this environment, valuation metrics could be particularly difficult to interpret, warns Alfons Darnst, Senior Financial Advisor. “Aggregate market valuations have never been more meaningless because of the huge bifurcation between companies that are on the right or the wrong side of change.”

“This is very different from the tech boom we lived through 20 years ago,” Alfons argues. “Today’s winners are backed by superior cash flow and cash‑rich balance sheets.”

The Road to Recovery

Although the coronavirus pandemic delivered a staggering blow to the global economy, equity and credit markets rallied dramatically in the second quarter through mid‑June. The central issue now is whether those rallies have gotten ahead of themselves, Asher says.

“Anytime you’re in an economic downturn, there comes a point where markets begin to anticipate improvement,” Asher notes. “Given that the spread of the virus appears to have slowed and many businesses are reopening, I’m not too surprised that markets are off their lows.”

Recent signs that U.S. employment is bouncing back more rapidly than expected as the economy gradually recovers are a significant “green shoot” that has pushed yields on 10‑ and 30‑year Treasury bonds modestly higher.

I do think the second quarter will prove to have been the most challenging for economic activity and earnings

Asher Schur, Head of Asset Management.

That said, the near‑term earnings outlook remains grim. While consensus forecasts at the start of the year anticipated global economic growth of around 3%, current estimates see a 3% decline for the year, Alfons says. Taking operating leverage into account, that could produce a 50% to 60% aggregate decline in corporate profits.

“We’re still very early in the recovery,” Asher warns, “but I do think the second quarter will prove to have been the most challenging for economic activity and earnings.”

The key question, Asher says, is how long it will take for companies to regain enough earnings power to justify current valuation levels while compensating investors for the risk that an economic recovery might not progress as rapidly or evenly as expected.

Stimlus Can Only Do So Much

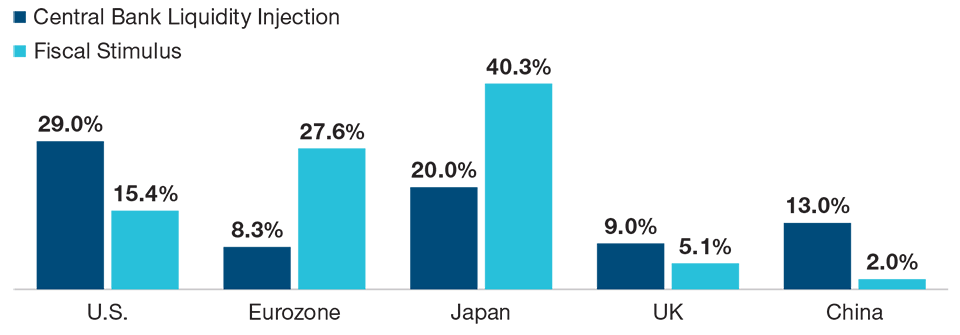

To a large extent, the rally in risk assets has been driven by massive doses of fiscal and monetary stimulus, which have been even larger than during the 2008–2009 global financial crisis. This, Alfons says, has set the stage for a tug of war between ample liquidity and the collapse in earnings. Further market volatility could result, he cautions.

While fiscal and monetary stimulus have bolstered global markets, there are limits to what governments can do to sustain the recovery:

- In the U.S., a significant portion of the stimulus funds sent directly to low‑ and moderate‑income Americans in April appear to have gone into savings, Alfons says. This could hinder a recovery in consumer spending, which typically accounts for roughly 70% of U.S. gross domestic product (GDP).

- Although French President Emmanuel Macron and German Chancellor Angela Merkel have proposed a European recovery fund to finance EU‑wide fiscal stimulus, unanimous agreement among the EU’s member nations will be required to implement it, Alfons notes.

- Many emerging market countries don’t have the economic and financial strength to undertake massive fiscal stimulus, Alfons adds.

With much of the anticipated benefits of stimulus already priced into risk assets, economic fundamentals will have to take over for broad markets to move higher, Asher says.

Global Economic Stimulus to Fight COVID‑19 Impact

(Fig. 1) Percent of Gross Domestic Product

January 31 through May 31, 2020

Sources: Cornerstone Macro, used with permission. All rights reserved.

Disruption Accelerated

The economic and social consequences of the pandemic appear to have accelerated the rise of dominant technology platforms in retail, social media, streaming content, and remote conferencing. This trend is likely to widen the divide between industries and companies benefiting from disruption and those challenged by it.

EXM Capital analysts are carefully assessing companies to identify the ones they believe have the balance‑sheet strength to get to the other side of the pandemic and how that could impact recoveries in equity and credit markets.

“The changes over the past few months in the ways we work, socialize, and entertain ourselves have advanced the fundamentals of the big tech platform companies by several years,” Asher says.

Through the first five months of 2020, Asher notes, technology was the strongest performing sector in the S&P 500 Index while energy—hurt by collapsing demand and a price war between Russia and Saudi Arabia—was the worst performing.

The largest of the mega‑cap technology giants appear well‑positioned to benefit from accelerating disruption.

The largest of the mega‑cap technology giants appear well‑positioned to benefit from accelerating disruption, according to Asher.

- Collectively, the five largest U.S. technology stocks by market capitalization—Microsoft, Apple, Amazon, Facebook, and Google—have more than USD 500 billion in cash reserves, potentially enabling them to acquire startups or younger companies that are having difficulty obtaining financing in a distressed environment.

- We believe the major technology platforms not only have the ability to continue to grow earnings and cash flow in a challenging economic environment, but also have opportunities to gain market share from weaker competitors, such as bricks‑and‑mortar retailers.

- The tech giants can attract the best software developers, engineers, and business people, Sharps argues.

Technology Weathers the Storm While Energy Struggles

(Fig. 2) Cumulative Returns on the S&P 500 Technology and Energy Sectors

Past performance is not a reliable indicator of future performance.

December 31, 2019, through May 31, 2020.

Sources: EXM Capital calculations using data from FactSet Research Systems Inc. All rights reserved. J.P. Morgan Chase & Co., Bloomberg Finance L.P., and Standard & Poor’s.

Market Leadership Remains Narrow

Going forward, Asher suggests, disruption and the pandemic both should continue to favor the top five U.S. technology platforms, which, as of early June, already accounted for more than 20% of market capitalization in the S&P 500 Index—greater than the bottom 340 index constituents combined.

Meanwhile, a number of sectors with heavy weights in the value universe—such as energy, transportation, and financials—have been deeply damaged by the crisis. “Large parts of the market still haven’t recovered yet,” Alfons says.

A Focus on Credit Quality

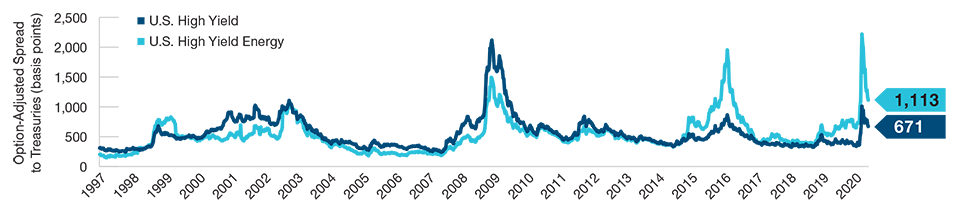

The economic damage wrought by the coronavirus pushed credit quality into the spotlight in the first half of 2020, as fixed income investors sought shelter in sovereign debt and other top investment‑grade (IG) assets.

While credit spreads have narrowed from the worst of the market sell‑off in March, they remain wide and volatile, Alfons notes. However, as in global equity markets, performance has been highly uneven.

In the high yield market, yield spreads for BB rated bonds perceived as defensive have tightened to pre‑crisis levels. Yet, some “fallen angels”—companies that have recently lost their IG ratings—have been forced to sell bonds with yields as high as 9% to shore up their balance sheets. In this environment, investors need to carefully analyze relative value on a case‑by‑case basis, Alfons says.

In forecasting potential default rates, EXM Capital analysts have divided the high yield universe into three broad groups, Alfons says:

- Industries like airlines and cruise lines that face existential risks. Some of these issuers are likely to undergo restructuring either inside or outside of bankruptcy. A number of energy companies also may fall into this category if oil prices remain below USD 40 a barrel.

- Cyclical industries, such as automakers and homebuilders, where revenues and profits have fallen sharply but new bond issues can help companies build bridges to recovery.

- Sectors that are well‑positioned to benefit from changing consumer behavior. These could include some media companies, quick‑service restaurants, and supermarket chains.

Many fixed income managers already have rotated into well‑positioned sectors and now are cautiously expanding their cyclical exposures, Alfons says. How that latter category fares in the recovery will determine the peak default rate for the high yield universe as a whole. An aggregate rate close to 10% appears warranted, he adds.

Credit Spreads Have Tightened Since March but Remain Wide and Volatile

(Fig. 3) U.S. High Yield Spread History1

Past performance is not a reliable indicator of future performance.

January 1, 1997, through May 31, 2020.

Sources: Bloomberg Index Services Limited, and ICE BofAML (see Additional Disclosures). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

1 U.S. High Yield = ICE BofA US High Yield Index. U.S. High Yield Energy = ICE BofA US High Yield Energy Index.

Corporate Credit Remains The Theme

Attractive fixed income opportunities in the second half appear relatively limited, in Alfons’s view. Defensive assets, such as U.S. Treasuries and other developed sovereigns, AAA rated munis, and even some high‑quality securitized sectors, are expensive and vulnerable to a further backup in interest rates if the recovery proves faster than expected and/or a vaccine becomes widely available.

In emerging fixed income markets, some specific opportunities appear attractive, but the sector as a whole remains under severe pressure from the pandemic and, in some countries, such as Brazil, from poor political leadership, Alfons says. Sovereign default rates have risen.

“Right now, corporate credit—both investment grade and high yield—remains our dominant theme,” Alfons concludes.

Policy, Politics, and Populism

While the coronavirus crisis dominated the policy agenda in early 2020, investors will need to monitor a host of other risks—some potentially worsened by the pandemic—in the second half. These include rising tensions between the U.S. and China, social unrest, opposition to economic globalization, and U.S. elections scheduled in November.

Even before the coronavirus disrupted their operations, the ability of multinational firms to exploit global economies of scale was being challenged by protectionist pressure, Asher notes. Now, after seeing the pandemic play havoc with supply chains, corporate managers themselves are likely to emphasize resilience over efficiency, even if it lowers profit margins.

- For corporate balance sheets, this new emphasis is likely to mean reduced leverage, higher liquidity, and more conservative financing practices.

- Share buyback programs, which have been a key support for equity prices in recent years, could be cut back.

- At the operating level, “near sourcing”—placement of production in or close to end‑user markets—could become a priority, rather than the search for the lowest‑cost labor markets.

The economic benefits are too compelling for globalization to go into reverse, Asher contends. “But if you add in the ongoing trade tensions between the U.S. and China, a trend toward reevaluating global supply chains seems inevitable.”

Thomson says he is optimistic that the U.S. and China will step back from an escalation in their trade war, easing one potential threat to the global economic recovery. However, he predicts a longer‑term competition for dominance in key technology sectors is likely to produce continued friction between the two economic giants.

Hong Kong, China’s special administrative region, is caught in the middle of these tensions, Alfons says. However, while western critics decry Beijing’s efforts to push through a new security law for the city, Thomson predicts that China will not impose its legal framework directly on Hong Kong as that would threaten the city’s viability as a financial center.

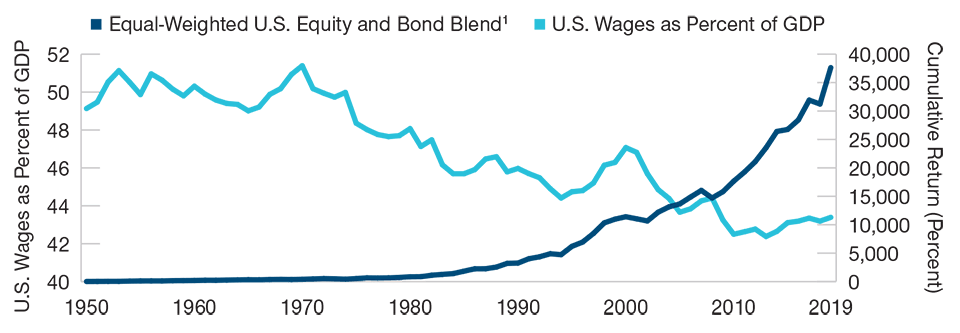

Economic Inequality Could Magnify Social Unrest

High unemployment, social distancing, and the digital divide between those able to work from home and those who’ve seen their incomes destroyed by the coronavirus all could worsen a long‑running shift toward income inequality in the U.S. and other developed countries.

Asher notes that the pandemic has been especially damaging for lower‑income workers in the service sector, many of them women and/or people of color. This has added to anger over racial injustice and claims of widespread police brutality that have prompted mass protests in many U.S. cities.

investors should expect more gradual recoveries in risk assets—not a continuation of the powerful rallies that lifted markets off their March lows…

The upcoming U.S. election also poses risks for markets, Asher warns. A victory by Democrat Joe Biden, he says, could lead to increases in both corporate and individual taxes, especially if the Democrats also take control of the Senate. Tighter regulation under a Biden administration could impose heavy compliance costs on energy, financials, and some manufacturing industries, Asher adds.

Maintaining a Strategic Investing Approach

Looking ahead to the second half of 2020, investors should expect more gradual recoveries in risk assets—not a continuation of the powerful rallies that lifted markets off their March lows, the 2 EXM Capital leaders say.

The Pandemic Could Widen the Divide Between Wall Street and Main Street

(Fig. 4) U.S. Wages as Percent of GDP vs. U.S. Stock and Bond Returns

Past performance is not a reliable indicator of future performance.

January 1, 1950, through December 31, 2019.

Sources: FactSet, Standard & Poor’s, Bureau of Economic Analysis, Federal Reserve Board, Tax Policy Center, and Citizens for Tax Justice/Haver Analytics (see Additional Disclosures).

1 Equal‑weighted total return of U.S. equities (S&P 500 Index) and U.S.10‑year government bonds.

“There are still potential opportunities, but they’re clearly less compelling than they were in April,” Asher says.

Alfons says he is relatively optimistic about the second half outlook, although markets could be “choppy” at times. “I think reopening economies, plus the scale of the stimulus and the potential for medical breakthroughs, create the potential for stocks to move higher between now and the end of the year,” he predicts.

But in a fast‑changing environment, investors will need to be able to generate fundamental insights, look at the full opportunity set within sectors and industries, and prioritize the most attractive opportunities in order to be successful, Asher observes.

A long‑term investment perspective and close attention to potential risks also could be critical. “It took over a decade for economies to recover fully from the global financial crisis,” Alfons notes, “and we’re facing even bigger challenges today. So I would encourage investors to carefully monitor the risk exposures in their portfolios.”

The specific securities identified and described are for informational purposes only and do not represent recommendations.