You deserve the best for retirement

How have your retirement savings been faring through COVID-19?

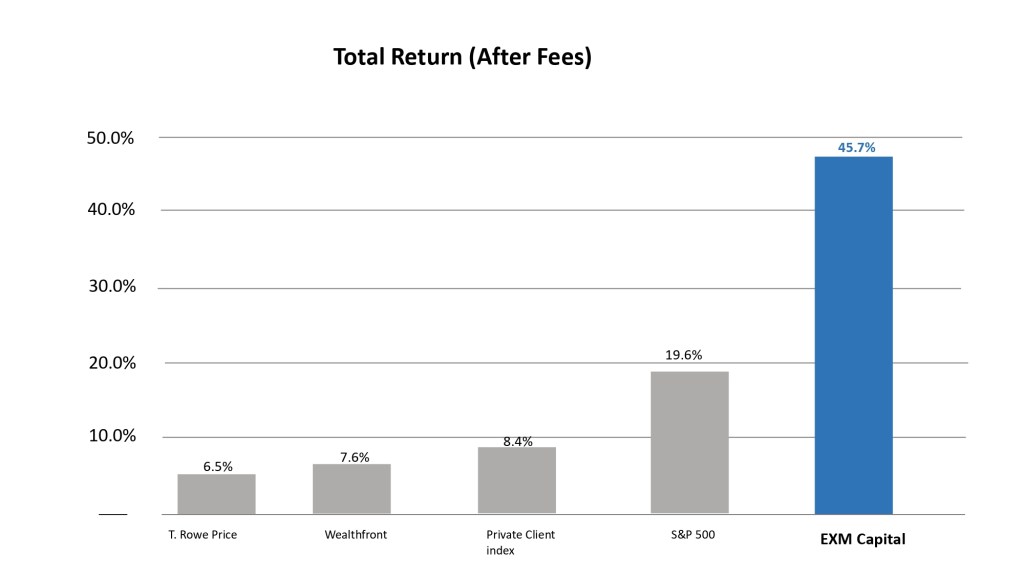

Since our retirement accounts Inception Date on 2/20/2018, EXM accounts with an Aggressive risk profile have gained +45% after fees. That’s +45% more net profit than Betterment, +30% more than Wealthfront, and +18% more than the S&P 500.

For a $100K account, you would have gained an extra $45K+ in just two years by investing it with EXM Capital instead of Betterment or Wealthfront, and an extra $18K versus a simple S&P 500 index fund.

If you’re like most folks:

- You probably have an old 401(k) or 403(b) from a past employer.

- You may have a few IRA accounts (Traditional, Roth, SEP, Rollover).

- You’ve likely seen those accounts decline meaningfully this year amidst the coronavirus sell-off.

- You likely paying hefty administrative fees and/or expense ratios (often adding up to 1.5-2.0%+ fees) on top of subpar performance

EXM Capital IRA clients are different:

- Hundreds have rolled over 401(k), 403(b), and IRA accounts into EXM Traditional and/or Roth IRAs.

- They have grown their capital +12-8% YTD through the volatility.

- They pay a simple 4% annual fee (at most), with ability to reduce that to 0% by referring a few clients.

When it comes to your retirement savings, you deserve the best possible long-term compounded returns. We aim to deliver them via high-quality, actively managed portfolios of the world’s best companies.

Rollovers are quick and easy

Just reply to this email with a statement for the account you wish to roll over. Our Rollover Concierge will handle the entire process from there. Your retirement funds can be invested in a EXM IRA in a matter of days.

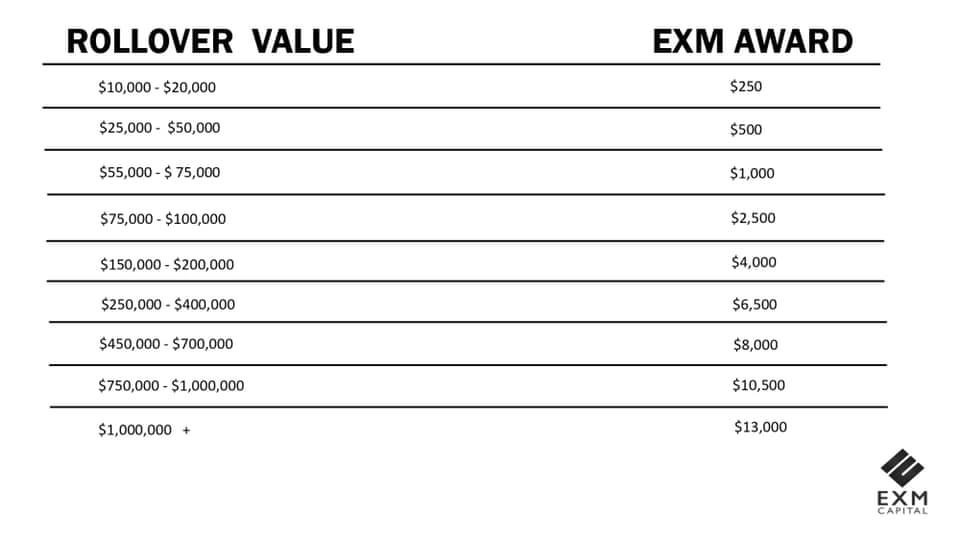

Plus, we’re giving you up to $13,000 in rewards when you roll over retirement accounts to EXM Capital.

Retirement account FAQs

What kinds of retirement accounts can I roll over?

We accept IRA transfers (Traditional, Roth, SEP, SIMPLE), 401K and 403B rollovers, and even non-taxable account transfers of $10,000+.

Can I roll over part of my funds instead of the entire account?

For IRAs, yes. For 401(k) and 403(b) plans, It depends on your plan provider’s policy. Ask them if they allow “partial rollovers.” If they do, then you can inform them of the specific amount you would like liquidated and rolled over to EXM Capital.

What is the investment strategy for EXM IRAs?

Your IRA will be invested in the same Flagship strategy as our Individual accounts. However, you can designate a different risk profile for your IRA vs. your Individual account, which would dictate a different hedge level.

What are the fees for EXM IRAs?

The annual fee for IRAs is a simple 4% of assets, the same as Individual accounts

Will my referral credits apply to a EXM IRA?

Yes! Your referral credits will apply to all your EXM Capital assets (Individual and IRA accounts)

Will a rollover result in any taxes or penalties?

No, direct rollovers of 401(k), 403(b), and IRA accounts do not incur any taxes or penalties.

Will I be charged any fees to roll over my IRA, 401(k), or 403(b)?

No, we do not charge any fees for incoming rollovers. However, your retirement account provider may charge an outgoing fee. Check with them if you’re unsure.

Do I need to sell any investments in my retirement account(s) before rolling over?

No, we can usually handle this for you. As a reminder, selling your investments is *not* a taxable event because you are selling shares in a tax-advantaged account.

Other questions?

Reply to this email and a member of our Rollover Concierge will be happy to assist you