Rising Tension Between U.S. and China Elevates Trading Issues

July 30 2020

U.S. measures could increase oversight of Chinese companies

Key Insights

“Tough on China” policies could limit trading of Chinese securities on U.S. exchanges.

Pressure mounts to subject Chinese companies to the same accounting scrutiny faced by other public companies traded in the U.S.

Federal and state government retirement funds are facing pressure to restrict investment in Chinese companies.

With China becoming a high‑profile issue in the U.S. presidential election, much of the friction has centered on trade disputes and the coronavirus outbreak. Several efforts are also underway in the U.S. to address a longer‑standing issue: whether Chinese companies are creating risks to investors and markets by skirting U.S. audits and regulatory oversight. How these legislative and regulatory issues evolve could have implications for financial markets, including potential limitations on the trading of Chinese securities.

Potential Ban of Chinese Securities on U.S. Exchanges

The U.S. Congress and U.S. regulators are furthering efforts to prevent companies in emerging markets, particularly those in China, from seeking to benefit from U.S. capital markets if they do not undergo the same level of oversight as companies in the U.S. and other developed market countries. An estimated 224 U.S.‑listed companies with about USD 1.8 trillion in market capitalization could be impacted by the legislative and regulatory measures.¹

Congress is considering legislation that could lead to the delisting of Chinese securities traded on U.S. stock exchanges unless the companies accept regular public review and oversight of their accounting practices. In addition, Nasdaq has proposed new rules that would codify its authority to apply more stringent listing criteria of companies in “restrictive markets” due to concerns about a company’s auditor, inadequate disclosures, a lack of transparency from certain emerging markets, and a need for greater accountability and access to information.

These are long‑standing regulatory concerns, as Chinese firms have raised billions of dollars by listing their shares on U.S. stock exchanges while avoiding the auditing scrutiny that other public firms must submit to. For years, the Public Company Accounting Oversight Board (PCAOB), which oversees the audits of public companies, has flagged “China Related Access Challenges” that have hindered the agency’s capacity to gain “complete and timely access” for inspections and investigations of Chinese public companies.

In the U.S. Congress, the Senate has approved a bill aimed at tighter regulations, while the House is considering similar legislation. The Senate bill, Holding Foreign Companies Accountability Act, would require certain companies to disclose whether they are “owned or controlled by a foreign government” and would potentially prohibit the trading of securities of U.S.‑listed companies audited by firms that the PCAOB cannot inspect.

Though the measure’s future is uncertain, key members of Congress are committed to heightening the regulatory risk profiles of Chinese firms.

Katie Smalling, Washington Analyst, U.S. Equity Division

The goal is to ensure that the PCAOB has access to inspect Chinese audit firms in the same manner as they inspect U.S. audit firms and those located in other nations. Thus, it would allow the PCAOB to audit their financials at least every three years. Companies that do not comply with these requirements could face delisting from U.S. exchanges.

“Though the measure’s future is uncertain, key members of Congress are committed to heightening the regulatory risk profiles of Chinese firms,” said Katie Smalling, Washington Analyst, U.S. Equity Division. Any delisting would not happen until 2025, so affected companies would have time to relocate their listings or put in place the required measures to comply.

Several of China’s largest technology firms are listed in the U.S., but they have the capacity to shift their listings as offerings in Hong Kong. In fact, most of T. Rowe Price’s foreign holdings consist of Chinese American Depository Receipts (ADRs), which also have secondary listings on the Hong Kong Exchange, enabling the firm to exchange ADR shares for the Hong Kong listing with minimal impact to portfolios. However, several operational processes would have to be established with some clients to allow for trading on non‑U.S. exchanges. In addition, custodian relationships may need to be set up on a global platform.

Ernest Shervani, co‑head, Global Equity, says the firm “continually monitors risks to our holdings, including regulatory factors. Predicting regulatory events is especially difficult; as a result, sentiment around regulatory risk can lead to large short‑term movements in stock prices. Our team of analysts and portfolio managers draw upon deep industry contacts as well as their own experiences and insights to assess these situations. We continue to monitor this situation and its implications for individual companies.”

Restricting Investment in Chinese Securities

Scrutiny of Chinese companies could also impact the retirement savings of federal and state workers. The U.S. Federal Retirement Thrift Investment Board (FRTIB), which manages federal government retirement funds, has decided to put on hold its plan to shift USD 593.7 billion from the Thrift Savings Plan’s I Fund benchmark MSCI EAFE Index of developed markets to the MSCI ACWI ex USA Investable Market Index, which includes China and other emerging markets.

The Board cited concerns about the potential impact of the coronavirus on emerging markets “because those markets are going to be challenged and we’re not sure what they’re going to look like over the next two or three years,” said Michael D. Kennedy, chairman of the FRTIB. However, the Board also was under heavy pressure from the Trump administration to reverse the earlier decision. On May 4, President Donald Trump nominated three people to the five‑member Board that, upon Senate confirmation, could lead to a new majority. The Board also received letters from administration officials citing “national security and humanitarian concerns for the United States.”

State retirement plans may face similar pressure. Florida Senator Marco Rubio and Congressman Michael Waltz sent a letter to Florida’s governor and other officials demanding that they divest state retirement money from Chinese companies. Governor Ron DeSantis has said he may push for that in 2021.

“The reversal by the federal government is a symbolic move, but it is not expected to have a significant immediate financial impact on China,” says Chris Kushlis, Fixed Income Sovereign Analyst, Asian Markets. “What could be more meaningful is if other public pension plans at the state and local levels in the U.S. also come under pressure to exclude Chinese securities. That’s important to monitor.”

Quick Snapshot – US Financial Markets

Economic and political backdrop

Wall Street began last week on a negative note, with worries about the resurgence of the coronavirus across much of the US seemingly weighing on sentiment. Renewed shutdowns in California appeared to be a particular focus of worry, with indoor dining at restaurants prohibited and the Los Angeles and San Diego school districts announcing a return to online classes in the fall. The resurgence also seemed to be showing up in high-frequency economic data, such as restaurant reservations and travel indicators.

Good news on the vaccine front at midweek appeared to ease resurgence concerns, helping stock markets move higher. After the close of trading Tuesday, Moderna Therapeutics announced its novel messenger RNA vaccine had produced high levels of antibodies in all test participants in an initial safety trial, although some experienced side effects. On Wednesday, Oxford University researchers announced that their vaccine candidate, which is under development with AstraZeneca, had produced not only antibodies in participants, but also “killer” T-cells that may offer prolonged immunity.

Both vaccine candidates are receiving support from the US government’s “Operation Warp Speed” programme, and advance steps in manufacturing mean vaccines may be available in limited quantities as early as the fall if further test results are positive. On Wednesday, Dr. Anthony Fauci, the nation’s top infectious disease official, said he believed the US would meet its goal of having a vaccine by year-end.

Tensions with China seemed to remain a modest drag on sentiment. President Trump did not announce any new measures against China at a press conference Tuesday, as some had feared, but White House officials stepped up their criticism of both its government and US companies that do business in the country. On Thursday, Attorney General William Barr was particularly pointed, accusing Disney, Apple and other US firms of “kowtowing” to the ruling Chinese Communist Party.

The week’s economic data were mixed. Manufacturing data were generally positive, with two regional gauges of factory activity indicating healthy expansion and coming in above expectations. June retail sales also beat expectations, but the University of Michigan’s preliminary gauge of July consumer sentiment fell back from June levels, which its chief researcher attributed to growing coronavirus worries. Weekly jobless claims surprised on the downside, falling only slightly from the previous week. Continuing claims fell more than expected, however.

Equity markets

In the US, the major indexes ended the week mixed. The S&P 500 recorded a gain of 1.3% (1.2% YTD), marking its third consecutive week of gains and reaching intraday levels not seen since the market sell-off began in late February. The index ended the week in positive territory for the year on total return basis. A shift out of higher-valuation growth shares into value stocks – the Russell 1000 Growth returned -0.8% (15.0% YTD) while Russell 1000 Value 3.4% (-12.6% YTD) – caused the technology-heavy Nasdaq Composite to pull back from its all-time highs, however. The market rotation was also evident in the outperformance of smaller-cap stocks, which have lagged considerably in recent months – Russell 2000 returned 3.6% (-10.8% YTD). Within the S&P 500, industrials shares outperformed by a wide margin, while technology stocks lost ground.

The week marked the unofficial start of the earnings season, with 32 of the S&P 500 companies scheduled to report second-quarter results, according to Refinitiv. Several major banks reported steep drops in profits as they set aside billions of US dollars in anticipation of writing down bad loans, but investors seemed encouraged in some cases by gains in underwriting and trading revenues. Analysts polled by FactSet currently expect overall profits for the S&P 500 to have contracted 44% in the quarter relative to a year before – if confirmed, it would be the worst performance since the 69% earnings drop amid the financial crisis in the final quarter of 2008.

Fixed income markets

Treasury yields decreased slightly through most of the week – 10-year Treasury yield ended the week at 0.63% – due, in part, to inflation readings that remained well below the Federal Reserve’s 2.0% annual target. Although a spike in gasoline prices in June contributed to a 0.6% increase in the headline CPI for the month – the biggest jump in nearly eight years – the core CPI reading, which excludes food and energy prices, was only 1.2% for the 12-month period.

The investment-grade corporate bond market saw light trading volumes amid fairly balanced buying and selling activity. Positive flows and modest new issuance due to earnings blackout periods provided technical support for the asset class, while the volume of new deals was well below early estimates. Light issuance, along with equity gains and continued flows into the asset class, supported the high yield market. Buyers were generally more active than sellers, although our traders noted that the summer lull in overall trading volumes appears to have set in.

The week in review- US Financial Markets

Economic and political backdrop

US stocks jumped at the start of trading last Monday, with many attributing the strength to a front-page editorial in the China Securities Journal, stating that “fostering a healthy bull market after the pandemic is now more important to the economy than ever”. Growing hopes for a COVID-19 vaccine being released as early as the end of the year also seemed to support the gains, but few concrete developments appeared to drive the rally.

Stocks drifted lower over the next few sessions as optimism about progress in fighting the pandemic appeared to drain away. More states announced increases in newly diagnosed cases and hospitalisations, and several governors announced new restrictions or delays in reopening measures. By the end of the week, the US had crossed the threshold of 60,000 new cases reported in a single day, with over 3 million confirmed cases recorded since the start of the pandemic. On Friday, however, stocks seemed to get a lift after Gilead Sciences announced a new study showing that remdesivir, its COVID-19 treatment, might reduce mortality rates in severely ill patients by nearly two-thirds. Earlier studies had demonstrated only that remdesivir could shorten hospital stays.

Investors appeared to be particularly concerned that the impact of the resurgence in the virus seemed to be showing up in economic data. In an interview published Tuesday morning, Atlanta Federal Reserve Bank President Raphael Bostic told a reporter that high-frequency data “suggest that the trajectory of this recovery is going to be a bit bumpier than it might otherwise.” Later that day, his counterpart at the Cleveland Federal Reserve Bank, Loretta Mester, told CNBC that it was likely “to take quite a long time to get back to where activity and employment was pre-pandemic.” On Thursday, however, St. Louis Federal Reserve Bank President James Bullard struck a markedly different tone, telling CNBC that “I think we’re tracking very well right now” and predicting that the unemployment rate could fall as low as 7% by the end of the year.

The week’s major economic reports generally surprised on the upside but may have been dismissed by some investors as largely reflecting conditions before the recent resurgence in the virus. The Institute for Supply Management’s gauge of service sector activity rose more than expected in June and nearly matched its February level, before the recognised onset of the pandemic. Job openings in May also rose more than expected, while weekly initial and continuing jobless claims fell more than anticipated.

Equity markets

The S&P 500 recorded a gain of 1.8% (-0.1% YTD). The major indexes ended mixed for the week, with large-caps outperforming small-caps – Russell 2000 returned -0.6% (-13.9% YTD). The technology-heavy Nasdaq Composite fared best, reaching new record highs, thanks in part to strong gains for “work from home” shares. Growth stocks outperformed value shares – the Russell 1000 Growth returned 3.5% (16.0% YTD) while Russell 1000 Value 0.3% (-15.5% YTD). Social and streaming media stocks boosted the communication services sector, which outperformed within the S&P 500, while energy shares were weak as WTI crude oil prices fell back below USD 40 per barrel.

Fixed income markets

Longer-term Treasury yields decreased through most of the week on growing virus concerns and briefly slid to levels last seen in late April, aided by particularly strong demand in the Treasury Department’s 10-year note and 30-year bond auctions. The 10-year Treasury yield ended the week modestly lower at 0.65%.

The investment-grade corporate bond market saw light trading volumes and modest new issuance, but market sentiment received a boost after Bullard’s optimistic comments Thursday. It was also a quiet week in the high yield market. Buyers were more active than sellers as the asset class continued to experience positive flows, and demand outstripped supply due to modest new issuance.

You deserve the best for retirement

How have your retirement savings been faring through COVID-19?

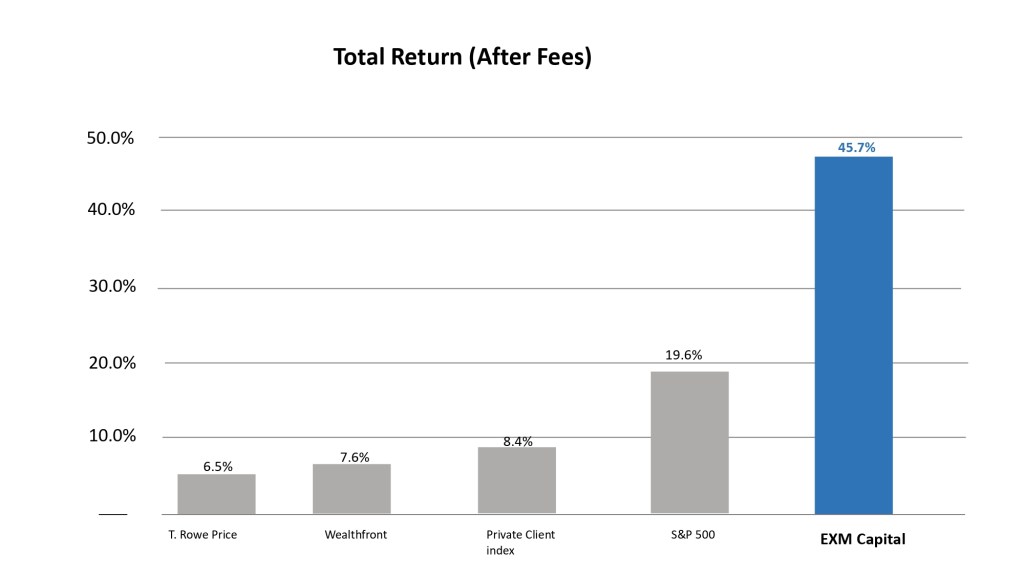

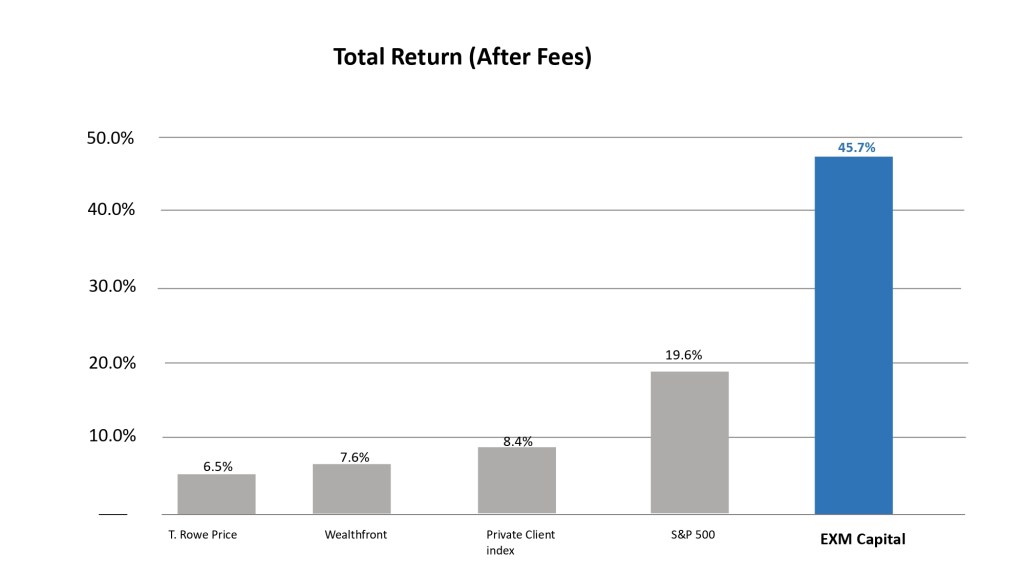

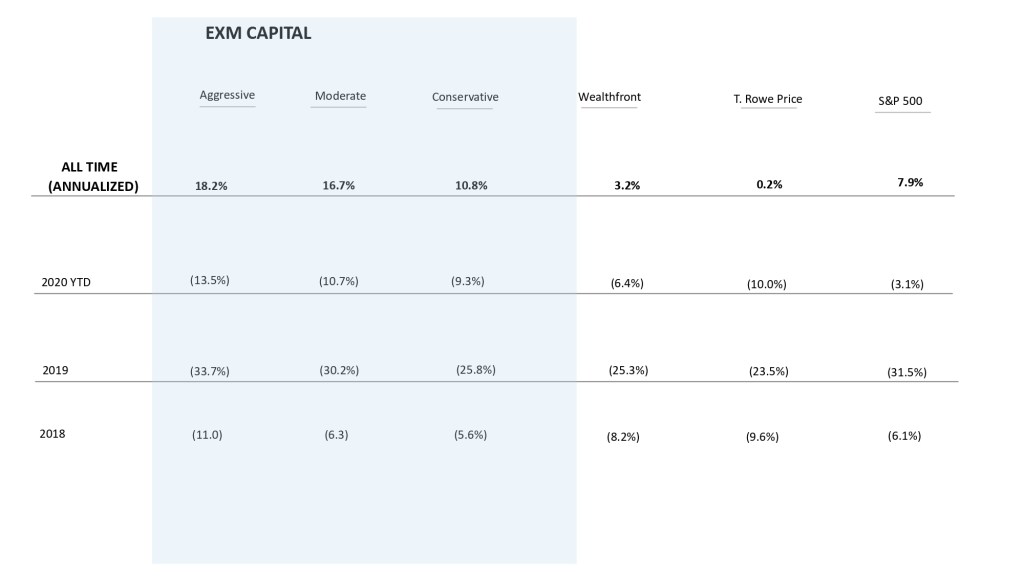

Since our retirement accounts Inception Date on 2/20/2018, EXM accounts with an Aggressive risk profile have gained +45% after fees. That’s +45% more net profit than Betterment, +30% more than Wealthfront, and +18% more than the S&P 500.

For a $100K account, you would have gained an extra $45K+ in just two years by investing it with EXM Capital instead of Betterment or Wealthfront, and an extra $18K versus a simple S&P 500 index fund.

If you’re like most folks:

- You probably have an old 401(k) or 403(b) from a past employer.

- You may have a few IRA accounts (Traditional, Roth, SEP, Rollover).

- You’ve likely seen those accounts decline meaningfully this year amidst the coronavirus sell-off.

- You likely paying hefty administrative fees and/or expense ratios (often adding up to 1.5-2.0%+ fees) on top of subpar performance

EXM Capital IRA clients are different:

- Hundreds have rolled over 401(k), 403(b), and IRA accounts into EXM Traditional and/or Roth IRAs.

- They have grown their capital +12-8% YTD through the volatility.

- They pay a simple 4% annual fee (at most), with ability to reduce that to 0% by referring a few clients.

When it comes to your retirement savings, you deserve the best possible long-term compounded returns. We aim to deliver them via high-quality, actively managed portfolios of the world’s best companies.

Rollovers are quick and easy

Just reply to this email with a statement for the account you wish to roll over. Our Rollover Concierge will handle the entire process from there. Your retirement funds can be invested in a EXM IRA in a matter of days.

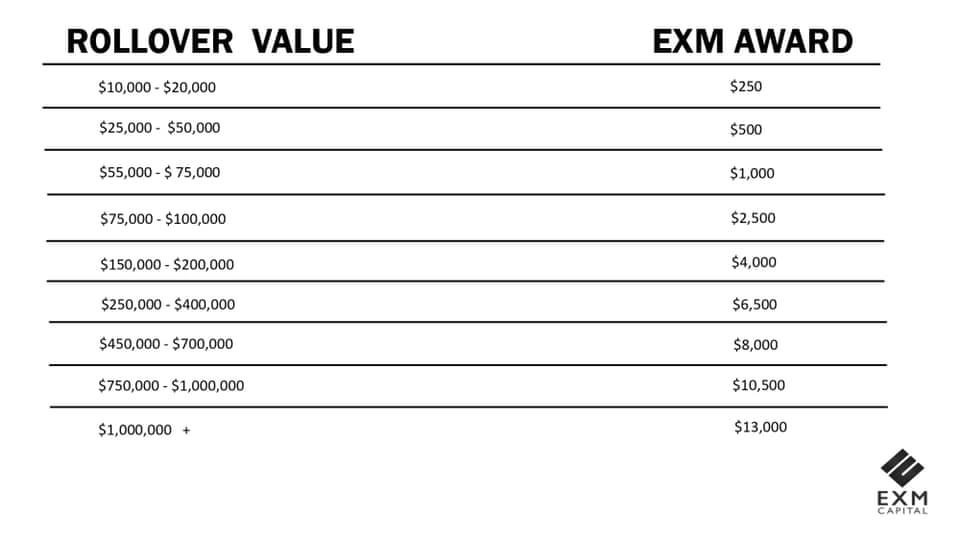

Plus, we’re giving you up to $13,000 in rewards when you roll over retirement accounts to EXM Capital.

Retirement account FAQs

What kinds of retirement accounts can I roll over?

We accept IRA transfers (Traditional, Roth, SEP, SIMPLE), 401K and 403B rollovers, and even non-taxable account transfers of $10,000+.

Can I roll over part of my funds instead of the entire account?

For IRAs, yes. For 401(k) and 403(b) plans, It depends on your plan provider’s policy. Ask them if they allow “partial rollovers.” If they do, then you can inform them of the specific amount you would like liquidated and rolled over to EXM Capital.

What is the investment strategy for EXM IRAs?

Your IRA will be invested in the same Flagship strategy as our Individual accounts. However, you can designate a different risk profile for your IRA vs. your Individual account, which would dictate a different hedge level.

What are the fees for EXM IRAs?

The annual fee for IRAs is a simple 4% of assets, the same as Individual accounts

Will my referral credits apply to a EXM IRA?

Yes! Your referral credits will apply to all your EXM Capital assets (Individual and IRA accounts)

Will a rollover result in any taxes or penalties?

No, direct rollovers of 401(k), 403(b), and IRA accounts do not incur any taxes or penalties.

Will I be charged any fees to roll over my IRA, 401(k), or 403(b)?

No, we do not charge any fees for incoming rollovers. However, your retirement account provider may charge an outgoing fee. Check with them if you’re unsure.

Do I need to sell any investments in my retirement account(s) before rolling over?

No, we can usually handle this for you. As a reminder, selling your investments is *not* a taxable event because you are selling shares in a tax-advantaged account.

Other questions?

Reply to this email and a member of our Rollover Concierge will be happy to assist you

In the Spirit of 4th of July, we wish all our American Clients and associates a HAPPY INDEPENDECE.

“Independence Day: Freedom has its life in the hearts, the actions, the spirit of men and so it must be earned and refreshed-else like a flower cut from its life giving roots, it will wither and die.”- Dwight D. Eisenhower

What you own

For EXM clients: (+) is a positive read-through, (-) negative, (~) neutral

(+) Amazon up 5% after forming a dedicated space division for its cloud segment, AWS. The company is betting on growth for their cloud computing services as public interest in space travel regains traction.

(+) Google up 2% after increasing the price of the Youtube TV streaming service by 30% (up to $65/Month). The latest price hike comes as the service acquires rights to several of ViacomCBS’s channels and is indicative of growing demand for online entertainment.

(~) Uber was flat after making a $2.6 billion offer for Postmates, while its Eats business waived fees for NYC eateries in an effort to gain market share from Grubhub.

Performance update

Our Flagship strategy gained +40% after fees in Q2, beating the S&P 500’s +21% and marking our best quarter in 2 years.

EXM clients are now up +12-8% YTD (vs. S&P 500 down -3% and advisors like Wealthfront and Betterment down -6% to -10%)

Represents total return from 2018 through June 2020.

Weekend Reads

Your boss wants you to take vacation (5 min read). How work-from-home dynamics have changed how employees and employers treat vacation time.

The boat business is booming (7 min read).In the era of socially-distant recreation, consumers are looking towards the waterfront for an escape from quarantine life.

How to build a more resilient business (13 min read). The Harvard Business Review on the keys to building sustainable and durable enterprises in the post-COVID world.

A detour

“Longevity in business is about being able to reinvent yourself or invent the future.”

— Satya Nadella, CEO of Microsoft

Managing to the Other Side

Asher Schur, Head of Asset Management, Alfons Darnst Senior Financial Advisor

Four themes driving our Midyear Market Outlook.

Key Insights

- The sustainability of rallies in equity and credit markets will depend on the trajectory of the coronavirus and the strength of the economic recovery.

- The pandemic appears to have accelerated the growth and market power of the major technology platform companies by at least several years.

- Corporate credit is likely to offer the most attractive opportunities to fixed income investors, but wide dispersion requires selectivity.

- We believe the pandemic could exacerbate political risks in some countries and prompt a major reassessment of corporate finances and supply chains.

Fiscal and monetary stimulus appeared to stave off the worst in capital markets since the coronavirus spread across the globe. But as economies gradually reopen, we believe a sustained recovery will largely depend on controlling the virus in the second half of 2020 and beyond.

“Investors should pay close attention to whether we get a second wave of infections as economies reopen,” cautions Asher Schur, head of asset management.Expectations that a vaccine can be developed and administered relatively quickly may be overly optimistic, he adds. Nor is it clear when effective drug therapies might become available. “There’s very limited visibility about that sort of relief.”

Amid uncertainty, asset returns are likely to remain uneven across countries, sectors, industries, and companies, creating potential to add value with a strategic investing approach but requiring careful analysis to identify opportunities and manage risk. “Investors will need to dig deeply to find the green shoots of recovery at the local level,” .

In this environment, valuation metrics could be particularly difficult to interpret, warns Alfons Darnst, Senior Financial Advisor. “Aggregate market valuations have never been more meaningless because of the huge bifurcation between companies that are on the right or the wrong side of change.”

“This is very different from the tech boom we lived through 20 years ago,” Alfons argues. “Today’s winners are backed by superior cash flow and cash‑rich balance sheets.”

The Road to Recovery

Although the coronavirus pandemic delivered a staggering blow to the global economy, equity and credit markets rallied dramatically in the second quarter through mid‑June. The central issue now is whether those rallies have gotten ahead of themselves, Asher says.

“Anytime you’re in an economic downturn, there comes a point where markets begin to anticipate improvement,” Asher notes. “Given that the spread of the virus appears to have slowed and many businesses are reopening, I’m not too surprised that markets are off their lows.”

Recent signs that U.S. employment is bouncing back more rapidly than expected as the economy gradually recovers are a significant “green shoot” that has pushed yields on 10‑ and 30‑year Treasury bonds modestly higher.

I do think the second quarter will prove to have been the most challenging for economic activity and earnings

Asher Schur, Head of Asset Management.

That said, the near‑term earnings outlook remains grim. While consensus forecasts at the start of the year anticipated global economic growth of around 3%, current estimates see a 3% decline for the year, Alfons says. Taking operating leverage into account, that could produce a 50% to 60% aggregate decline in corporate profits.

“We’re still very early in the recovery,” Asher warns, “but I do think the second quarter will prove to have been the most challenging for economic activity and earnings.”

The key question, Asher says, is how long it will take for companies to regain enough earnings power to justify current valuation levels while compensating investors for the risk that an economic recovery might not progress as rapidly or evenly as expected.

Stimlus Can Only Do So Much

To a large extent, the rally in risk assets has been driven by massive doses of fiscal and monetary stimulus, which have been even larger than during the 2008–2009 global financial crisis. This, Alfons says, has set the stage for a tug of war between ample liquidity and the collapse in earnings. Further market volatility could result, he cautions.

While fiscal and monetary stimulus have bolstered global markets, there are limits to what governments can do to sustain the recovery:

- In the U.S., a significant portion of the stimulus funds sent directly to low‑ and moderate‑income Americans in April appear to have gone into savings, Alfons says. This could hinder a recovery in consumer spending, which typically accounts for roughly 70% of U.S. gross domestic product (GDP).

- Although French President Emmanuel Macron and German Chancellor Angela Merkel have proposed a European recovery fund to finance EU‑wide fiscal stimulus, unanimous agreement among the EU’s member nations will be required to implement it, Alfons notes.

- Many emerging market countries don’t have the economic and financial strength to undertake massive fiscal stimulus, Alfons adds.

With much of the anticipated benefits of stimulus already priced into risk assets, economic fundamentals will have to take over for broad markets to move higher, Asher says.

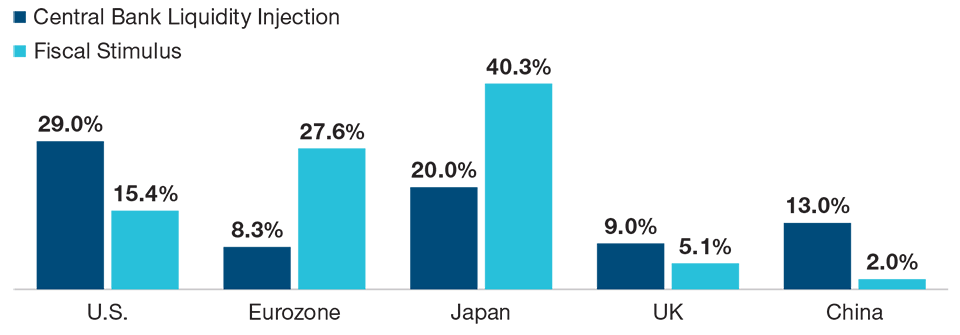

Global Economic Stimulus to Fight COVID‑19 Impact

(Fig. 1) Percent of Gross Domestic Product

January 31 through May 31, 2020

Sources: Cornerstone Macro, used with permission. All rights reserved.

Disruption Accelerated

The economic and social consequences of the pandemic appear to have accelerated the rise of dominant technology platforms in retail, social media, streaming content, and remote conferencing. This trend is likely to widen the divide between industries and companies benefiting from disruption and those challenged by it.

EXM Capital analysts are carefully assessing companies to identify the ones they believe have the balance‑sheet strength to get to the other side of the pandemic and how that could impact recoveries in equity and credit markets.

“The changes over the past few months in the ways we work, socialize, and entertain ourselves have advanced the fundamentals of the big tech platform companies by several years,” Asher says.

Through the first five months of 2020, Asher notes, technology was the strongest performing sector in the S&P 500 Index while energy—hurt by collapsing demand and a price war between Russia and Saudi Arabia—was the worst performing.

The largest of the mega‑cap technology giants appear well‑positioned to benefit from accelerating disruption.

The largest of the mega‑cap technology giants appear well‑positioned to benefit from accelerating disruption, according to Asher.

- Collectively, the five largest U.S. technology stocks by market capitalization—Microsoft, Apple, Amazon, Facebook, and Google—have more than USD 500 billion in cash reserves, potentially enabling them to acquire startups or younger companies that are having difficulty obtaining financing in a distressed environment.

- We believe the major technology platforms not only have the ability to continue to grow earnings and cash flow in a challenging economic environment, but also have opportunities to gain market share from weaker competitors, such as bricks‑and‑mortar retailers.

- The tech giants can attract the best software developers, engineers, and business people, Sharps argues.

Technology Weathers the Storm While Energy Struggles

(Fig. 2) Cumulative Returns on the S&P 500 Technology and Energy Sectors

Past performance is not a reliable indicator of future performance.

December 31, 2019, through May 31, 2020.

Sources: EXM Capital calculations using data from FactSet Research Systems Inc. All rights reserved. J.P. Morgan Chase & Co., Bloomberg Finance L.P., and Standard & Poor’s.

Market Leadership Remains Narrow

Going forward, Asher suggests, disruption and the pandemic both should continue to favor the top five U.S. technology platforms, which, as of early June, already accounted for more than 20% of market capitalization in the S&P 500 Index—greater than the bottom 340 index constituents combined.

Meanwhile, a number of sectors with heavy weights in the value universe—such as energy, transportation, and financials—have been deeply damaged by the crisis. “Large parts of the market still haven’t recovered yet,” Alfons says.

A Focus on Credit Quality

The economic damage wrought by the coronavirus pushed credit quality into the spotlight in the first half of 2020, as fixed income investors sought shelter in sovereign debt and other top investment‑grade (IG) assets.

While credit spreads have narrowed from the worst of the market sell‑off in March, they remain wide and volatile, Alfons notes. However, as in global equity markets, performance has been highly uneven.

In the high yield market, yield spreads for BB rated bonds perceived as defensive have tightened to pre‑crisis levels. Yet, some “fallen angels”—companies that have recently lost their IG ratings—have been forced to sell bonds with yields as high as 9% to shore up their balance sheets. In this environment, investors need to carefully analyze relative value on a case‑by‑case basis, Alfons says.

In forecasting potential default rates, EXM Capital analysts have divided the high yield universe into three broad groups, Alfons says:

- Industries like airlines and cruise lines that face existential risks. Some of these issuers are likely to undergo restructuring either inside or outside of bankruptcy. A number of energy companies also may fall into this category if oil prices remain below USD 40 a barrel.

- Cyclical industries, such as automakers and homebuilders, where revenues and profits have fallen sharply but new bond issues can help companies build bridges to recovery.

- Sectors that are well‑positioned to benefit from changing consumer behavior. These could include some media companies, quick‑service restaurants, and supermarket chains.

Many fixed income managers already have rotated into well‑positioned sectors and now are cautiously expanding their cyclical exposures, Alfons says. How that latter category fares in the recovery will determine the peak default rate for the high yield universe as a whole. An aggregate rate close to 10% appears warranted, he adds.

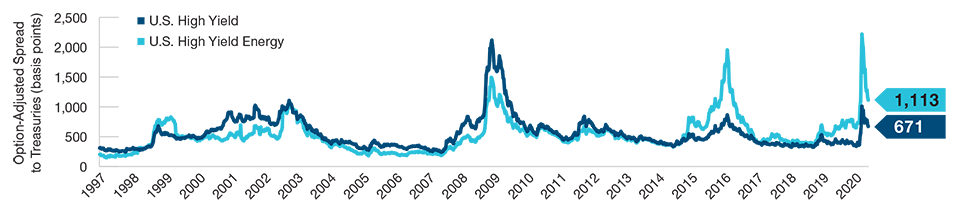

Credit Spreads Have Tightened Since March but Remain Wide and Volatile

(Fig. 3) U.S. High Yield Spread History1

Past performance is not a reliable indicator of future performance.

January 1, 1997, through May 31, 2020.

Sources: Bloomberg Index Services Limited, and ICE BofAML (see Additional Disclosures). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

1 U.S. High Yield = ICE BofA US High Yield Index. U.S. High Yield Energy = ICE BofA US High Yield Energy Index.

Corporate Credit Remains The Theme

Attractive fixed income opportunities in the second half appear relatively limited, in Alfons’s view. Defensive assets, such as U.S. Treasuries and other developed sovereigns, AAA rated munis, and even some high‑quality securitized sectors, are expensive and vulnerable to a further backup in interest rates if the recovery proves faster than expected and/or a vaccine becomes widely available.

In emerging fixed income markets, some specific opportunities appear attractive, but the sector as a whole remains under severe pressure from the pandemic and, in some countries, such as Brazil, from poor political leadership, Alfons says. Sovereign default rates have risen.

“Right now, corporate credit—both investment grade and high yield—remains our dominant theme,” Alfons concludes.

Policy, Politics, and Populism

While the coronavirus crisis dominated the policy agenda in early 2020, investors will need to monitor a host of other risks—some potentially worsened by the pandemic—in the second half. These include rising tensions between the U.S. and China, social unrest, opposition to economic globalization, and U.S. elections scheduled in November.

Even before the coronavirus disrupted their operations, the ability of multinational firms to exploit global economies of scale was being challenged by protectionist pressure, Asher notes. Now, after seeing the pandemic play havoc with supply chains, corporate managers themselves are likely to emphasize resilience over efficiency, even if it lowers profit margins.

- For corporate balance sheets, this new emphasis is likely to mean reduced leverage, higher liquidity, and more conservative financing practices.

- Share buyback programs, which have been a key support for equity prices in recent years, could be cut back.

- At the operating level, “near sourcing”—placement of production in or close to end‑user markets—could become a priority, rather than the search for the lowest‑cost labor markets.

The economic benefits are too compelling for globalization to go into reverse, Asher contends. “But if you add in the ongoing trade tensions between the U.S. and China, a trend toward reevaluating global supply chains seems inevitable.”

Thomson says he is optimistic that the U.S. and China will step back from an escalation in their trade war, easing one potential threat to the global economic recovery. However, he predicts a longer‑term competition for dominance in key technology sectors is likely to produce continued friction between the two economic giants.

Hong Kong, China’s special administrative region, is caught in the middle of these tensions, Alfons says. However, while western critics decry Beijing’s efforts to push through a new security law for the city, Thomson predicts that China will not impose its legal framework directly on Hong Kong as that would threaten the city’s viability as a financial center.

Economic Inequality Could Magnify Social Unrest

High unemployment, social distancing, and the digital divide between those able to work from home and those who’ve seen their incomes destroyed by the coronavirus all could worsen a long‑running shift toward income inequality in the U.S. and other developed countries.

Asher notes that the pandemic has been especially damaging for lower‑income workers in the service sector, many of them women and/or people of color. This has added to anger over racial injustice and claims of widespread police brutality that have prompted mass protests in many U.S. cities.

investors should expect more gradual recoveries in risk assets—not a continuation of the powerful rallies that lifted markets off their March lows…

The upcoming U.S. election also poses risks for markets, Asher warns. A victory by Democrat Joe Biden, he says, could lead to increases in both corporate and individual taxes, especially if the Democrats also take control of the Senate. Tighter regulation under a Biden administration could impose heavy compliance costs on energy, financials, and some manufacturing industries, Asher adds.

Maintaining a Strategic Investing Approach

Looking ahead to the second half of 2020, investors should expect more gradual recoveries in risk assets—not a continuation of the powerful rallies that lifted markets off their March lows, the 2 EXM Capital leaders say.

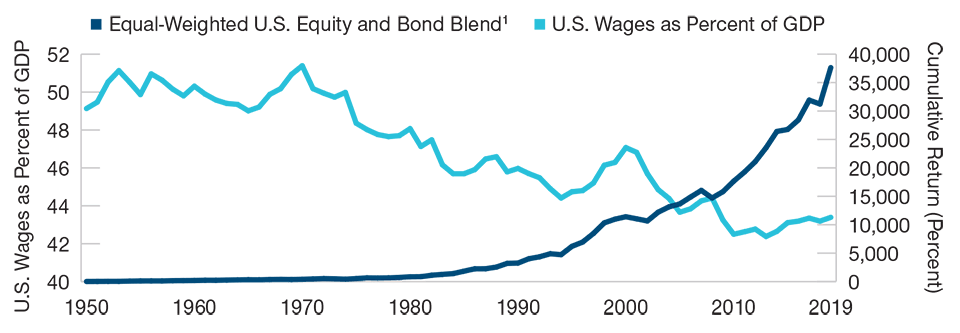

The Pandemic Could Widen the Divide Between Wall Street and Main Street

(Fig. 4) U.S. Wages as Percent of GDP vs. U.S. Stock and Bond Returns

Past performance is not a reliable indicator of future performance.

January 1, 1950, through December 31, 2019.

Sources: FactSet, Standard & Poor’s, Bureau of Economic Analysis, Federal Reserve Board, Tax Policy Center, and Citizens for Tax Justice/Haver Analytics (see Additional Disclosures).

1 Equal‑weighted total return of U.S. equities (S&P 500 Index) and U.S.10‑year government bonds.

“There are still potential opportunities, but they’re clearly less compelling than they were in April,” Asher says.

Alfons says he is relatively optimistic about the second half outlook, although markets could be “choppy” at times. “I think reopening economies, plus the scale of the stimulus and the potential for medical breakthroughs, create the potential for stocks to move higher between now and the end of the year,” he predicts.

But in a fast‑changing environment, investors will need to be able to generate fundamental insights, look at the full opportunity set within sectors and industries, and prioritize the most attractive opportunities in order to be successful, Asher observes.

A long‑term investment perspective and close attention to potential risks also could be critical. “It took over a decade for economies to recover fully from the global financial crisis,” Alfons notes, “and we’re facing even bigger challenges today. So I would encourage investors to carefully monitor the risk exposures in their portfolios.”

The specific securities identified and described are for informational purposes only and do not represent recommendations.

EXM Capital diversity and social justice

Company diversity and social justice

- know that diverse teams have potential to outperform and that these benefits accelerate as diversity develops into equity, inclusion, and belonging.

- For many U.S. companies, diversity information disclosure is currently limited in both breadth and depth.

- As fundamental researchers and active managers, we contribute to progress by seeking greater transparency from and personally engaging with company management.

“Maybe you are searching among the branches, for what only appears in the roots.” — Rumi

The “S” of ESG — social performance — has always been the hardest to measure, yet we believe it is the human element of business that makes everything else possible. When we talk with CEOs, regardless of the type of business they run, their top priorities and concerns are consistently people-related: employees, customers, and communities.

This has been even more amplified in recent months. First, attention to caring for employee safety and well-being intensified as the COVID-19 crisis accelerated. More recently, companies have become increasingly engaged in deeper considerations of diversity, inclusion, and racial justice in the wake of the killings of George Floyd, Breonna Taylor, Ahmaud Arbery, and many others.

Why are the standard metrics for “S” so unsatisfying?

Sustainable investing aims to take a more holistic view of corporate performance with the premise that over the long term there is no such thing as an externality (a consequence not counted as a cost). We believe that management teams who are effective leaders on relevant sustainability issues or who are solving key sustainability challenges are more likely to create thriving businesses.

At the same time that we recognize the complexity and nuance of this more expansive approach, we are investors who crave data and quantitative analysis and comparability. This is why we often use focused metrics like the percentage of women on a corporate board, which are relatively easy to monitor and analyze.

These narrowly defined metrics are important, but they are not complete.

How do we link individual metrics to deeper issues?

Whenever we analyze individual data elements for environmental, social, or governance issues, we aim to put the information in perspective. When it comes to diversity, data is currently limited in both breadth and depth. For example, gender diversity on corporate boards is frequently monitored by sustainable investors as a specific indicator of a single type of diversity in one part of an organization. This data, though defined in a limited, binary way, is useful, and it is more widely reported than other measures. Analyzing this information helps us to see trends over time and differences across companies, sectors, and regions, for this one specific dimension.

Similarly, data on racial diversity within firms can highlight important trends and disparities. Detailed information on racial diversity is not yet widely reported, but there is a growing level of disclosure, attention, and action from many leading companies. Increased transparency is important, since we know that company leadership teams rarely reflect the composition of the communities they intend to serve. This disconnect is a consequence of systemic racism, and it contributes to perpetuating bias throughout our organizations, with negative implications for both business and society.

Even if we had much more data, for any question that is worthy of deep investigation, it’s much more important to explore what lies beyond the surface level metrics. Board diversity is one small step toward examining diversity across multiple dimensions and throughout all parts of an organization. We believe diversity, in turn, is a step toward equity; equity is a step toward inclusion; inclusion is a step toward belonging; and belonging finally starts to approach the ultimate goal, justice.

Each individual metric is like one leaf on a tree; though we examine each leaf in depth, this is the beginning of our work, not the end. We always want to be connecting these specific indicators all the way back to the roots, to the most essential questions, to the most worthwhile ends.

“Diversity is a step toward equity; equity is a step toward inclusion; inclusion is a step toward belonging; and belonging finally starts to approach the ultimate goal, justice.”

What can we contribute?

As fundamental researchers and active managers, we can contribute two essential ingredients as we all work toward a just society. First, we are analysts. We can promote transparency, analyze data, and report on insights that lead us to the next best question. We can encourage exploration of unstructured data, tools like machine learning and AI, and new information sources to give a more complete view of companies, activity, and impact. We can work to uncover and address bias in all forms of data collection and analysis.

Second, we are active managers. This means we have direct human conversations with company management teams as a core part of our investment process. We know that the path toward diversity, equity, inclusion, belonging, and justice requires personal engagement that goes above and beyond research and analysis. Our process allows us to be part of that collective work.

We know that diverse teams have potential to outperform, we know that these benefits accelerate as diversity develops into equity, inclusion, and belonging, and we know that a just society is better for all. We will be glad to see reported metrics expand and improve, and we aim to promote thoughtful disclosure and analysis along the way. We are even more enthusiastic about the benefits beyond metrics that will be created for all stakeholders, and for all of society, as we collectively work toward justice.

Learn more about our approach to research and ESG data by reading our ESG integration process

Why ECF ?

Since inception in 2016, our ECF seeks to preserve Capital while also achieving capital appreciation for institutional and individual investors

The Objective of the fund is pursued, at varying levels of targeted capital appreciation and preservation, depending on class and strategy, through the implementation of multiple investment strategies. These strategies relate to investments in tokenized securities, tokenized assets, certain crypotcurrencies ( such as bitcoin, Ethereum, and other Future altcoins). Securities tokens, utility tokens,”mining,” tethers and other digital or crypto assets.

Strategies

The Fund is divided into 3 deliverable strategies ( 3 part Series)

𝐂𝐥𝐚𝐬𝐬 𝐓 ( 𝐓𝐫𝐚𝐝𝐢𝐧𝐠): Class T actively trades assets seeking to maximize capital appreciation with a secondary emphasis on capital appreciation (Aggressive approach). Class T is denominated in (USD). With a monthly dividend of 𝟒𝟎%-𝟒𝟓%.

𝐂𝐥𝐚𝐬𝐬 𝐁 (𝐁𝐢𝐭𝐜𝐨𝐢𝐧𝐬): Class B seeks to maximize capital preservation with a secondary emphasis on capital appreciation (Conservative approach). Class B is denominated in Bitcoin (BTC). Class B is an active strategy for long term holders of Bitcoin. With a monthly dividend of 𝟏𝟎%.

𝐂𝐥𝐚𝐬𝐬 𝐄 ( 𝐄𝐭𝐡𝐞𝐫𝐞𝐮𝐦): Class E seeks to balance capital appreciation and capital preservation. Class E is denominated in Ethereum ( ETH) with performance measured in ETH. Class E is an attractive strategy for those with a cache of Ethereum. With a monthly dividend of 𝟏𝟎%.

Control

- The Account owner retains sole ownership

- The Account owner maintains control of withdrawing.

- The beneficiary can be changed to another member of the same family without income tax consequences

- The Fund offers flexible payment and withdrawal options.

Risk Management

TRADING RISK MANAGEMENT

Part of the success of EXM Capital is our global trading risk management capability, dealing with high volumes of sophisticated multi-asset retail flow benefiting from a significant proportion of natural aggregation. Our strong capital and liquidity balances allow us to retain an element of net client portfolio risk, transferring the remaining risk through hedging to our external counterparties. This delivers a highly automated transactional based risk management strategy, allowing the business to deliver consistent and sustainable returns irrespective of underlying client performance and driving long term client engagement.

PRINCIPAL RISK AND UNCERTAINTIES

The company’s business activities naturally expose it to strategic, financial and operational risks inherent in the nature of the business it undertakes and the financial, market and regulatory environments in which it operates. The company recognizes the importance of understanding and managing these risks and that it cannot place a cap or limit on all of the risks to which the company is exposed, however effective risk management ensures that risks are managed to an acceptable level. The Board, through its Audit and Risk Committee, is ultimately responsible for the implementation of an appropriate risk strategy, which has been achieved by the establishment of an integrated Risk Management Framework. The main areas covered by the Risk Management Framework are:

• Identification, evaluation and monitoring of the principle risks to which the company is exposed.

• Setting the Risk Appetite of the Board in order to achieve its strategic objectives.

• Establishment and maintenance of governance, policies, systems and controls to ensure the company is operating within the stated Risk appetite.

RISK MANAGEMENT APPROACH FOR EXM CRYPTO FUND (ECF)

EXM Crypto Fund applies appropriate risk management practices ensuring that the Crypto Fund’s core processes and systems are effectively controlled, fit for purpose and that risk is managed effectively. Such practices are designed specifically for the risks inherent with Crypto Assets, including the risk associated with high volatility Crypto Assets with unique custody and valuation related exposures.

EXM Crypto Fund develops risk management strategies into a cohesive management framework with appropriate policies and procedures. To this end, EXM Crypto Fund identifies and assess its key current and potential risks, including risks to the Crypto Fund’s trading and custody systems, as well as risks to investors and the reputation of EXM. The EXM Crypto Fund formalizes, documents and monitor these risks on a periodic basis.

The Board of the EXM Crypto Fund is responsible for ensuring the effectiveness of its risk management framework, setting the risk appetite and overall risk tolerance limits as well as approving the key risk management strategies and policies. In particular, the Board of the EXM Crypto Fund is aware of, quantify (where possible) and monitor the risks associated with investing in and holding Crypto Assets.

The EXM Crypto Fund’s risk management framework assesses each specific risk facing the Crypto Fund and implement appropriate controls in order to monitor, manage and mitigate these risks, ensuring that these controls are designed and operating as expected. Where any deficiencies are identified, are logged off and, reported to the Board and remediated on a timely basis.